Posts Tagged ‘tax relief’

Bill Introduced to Provide Middle Class Tax Relief for Working Delawareans

A measure that would increase the standard deduction for personal income taxes by 75% in tax year 2024 – and increase the refundable Earned Income Tax Credit (EITC) to 7.5% of the federal credit for Tax Year 2023 has been introduced in the Delaware State House. House Bill 89 is sponsored by Representative Paul Baumbach…

Read MoreMd. Gas Tax Targeted As State Revenues Surge

Maryland revenue projections for the current and upcoming fiscal years have been revised upward by $1.6-billion, prompting more calls to provide Marylanders with tax relief. The Maryland Board of Revenue Estimates (Comptroller Peter Franchot, Treasurer Dereck Davis and Budget Secretary David Brinkley) voted Thursday to increase revenue projections to $22.5-billion for Fiscal Year 2022, up…

Read MoreParents’ Rights Surrounding Education Are Part Of Md. House GOP Caucus Agenda

Maryland House Republicans are putting forth legislation in 2022 focused on tax relief, limited government, and parental rights surrounding their children’s education. Delegate Jeff Ghrist, R-Caroline County is lead sponsor of the “Right to Learn Act of 2022.” According to the legislation: families of children in schools with two consecutive years of rating two stars…

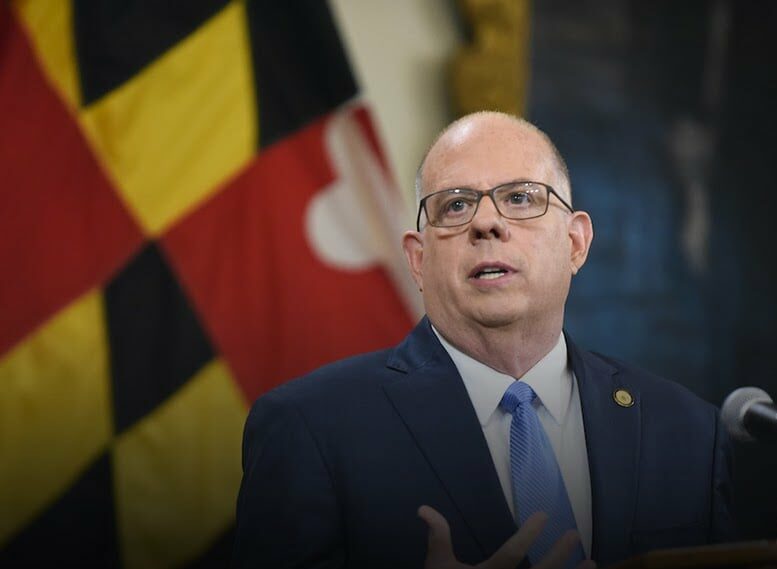

Read MoreVIDEO | Md. Gov. Hogan Sets Priorities In His Final State-of-the-State Address

Governor Larry Hogan Wednesday thanked Marylanders for their persistence through the COVID-19 pandemic, as well as providing him with the opportunity to serve as governor for two terms. The two-term Republican delivered his final State of the State Address. “My message to you tonight is that we must all learn to live with this virus,…

Read MoreDel. GOP Lawmakers Will Again Press For Tax Relief Bills

Sponsors of bills to cut taxes for Delawareans will try again to get surplus state revenues returned to taxpayers. Republican lawmakers have introduced a total of five bills that look to reduce Delawareans’ tax burden. Representative Rich Collins, R-Millsboro is sponsoring a measure (House Bill 191) that would cut the state’s personal income tax rates…

Read MoreMaryland Lawmakers Head Into 2022 Session

The Maryland General Assembly begins its 2022 90-day session Wednesday in Annapolis. “There is a lot of work to do getting our bills ready, starting to build consensus and getting signatures for cosponsors and so forth,” Delegate Wayne Hartman, R-Dist. 38C said to WGMD’s Mike Bradley on the day before the start of the session.…

Read MoreVIDEO | Md. Gov. Hogan Proposes $4.6-Billion In Tax Relief, Business Incentives

Heading into his final year in office, Maryland Governor Larry Hogan is proposing a total of $4.6-billion in tax relief for families, retirees and small businesses. One measure would eliminate 100% of state retirement taxes, phased in over time but starting in 2022. Hogan is also proposing expansion of the More Jobs for Marylanders program,…

Read MoreGov. Hogan: Use Md. Surplus For Tax Relief, Rainy Day Fund Growth

What should happen with Maryland’s recently reported budget surplus of $2.5-Billion? Governor Larry Hogan said Thursday that a significant portion should be saved for the state’s Rainy Day Fund. Hogan also wants to revisit a proposal to provide retirees with tax relief to keep them from moving out of the state. And, he wants to…

Read MoreHogan Signs RELIEF Act Into Law

Emergency legislation has been signed into law in Maryland that directs more than a billion dollars in tax relief and economic stimulus toward families that are struggling, small businesses, and Marylanders who have lost their jobs during the COVID-19 pandemic. Governor Larry Hogan signed the RELIEF Act of 2021 Monday, several weeks after he introduced…

Read More