Posts Tagged ‘tax credit’

Del. Senate Advances Tax Relief Bills For Retired Military, Active Fire-EMS

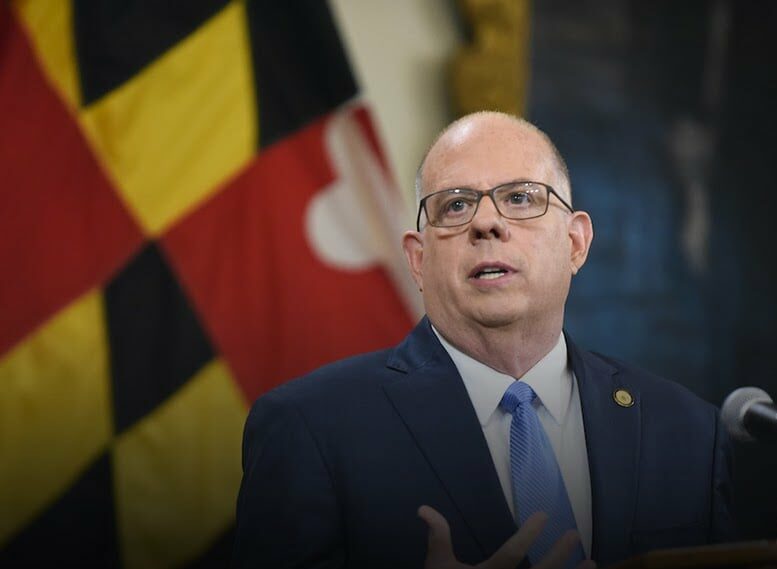

VIDEO | Md. Gov. Hogan Proposes $4.6-Billion In Tax Relief, Business Incentives

Heading into his final year in office, Maryland Governor Larry Hogan is proposing a total of $4.6-billion in tax relief for families, retirees and small businesses. One measure would eliminate 100% of state retirement taxes, phased in over time but starting in 2022. Hogan is also proposing expansion of the More Jobs for Marylanders program,…

Read MoreSome Eastern Shore Counties Outpace Md. Average Property Value Increases

Maryland property values have risen by 12-percent over the past three years for what are classified as Group One residential and commercial properties. The Maryland Department of Assessments and Taxation Tuesday announced results of its 2022 reassessment of more than 704-thousand properties. Maryland’s more than two-million property accounts are divided into three groups, each of…

Read MoreDel. Eligible Disabled Veterans May Apply For School Property Tax Credit

Eligible disabled veterans in Delaware may apply for a non-vocational school district property tax credit. Legislation signed by Governor John Carney over the summer allows school districts to grant the tax credit to eligible disabled veterans. All 16 non-vocational districts have approved the credit. To be eligible, applicants must: Receive 100% disability compensation due to…

Read MoreSen. Carper Cosponsors Theatre Tax Credit Legislation

The struggle is real for theatres and music performance venues which had to close during the pandemic, reopen with only limited capacity, and have hoped to lure a wary public to come back out and enjoy themselves. One venue that has faced such challenges is the historic Milton Theatre. Senator Tom Carper, D- Del., visited…

Read More